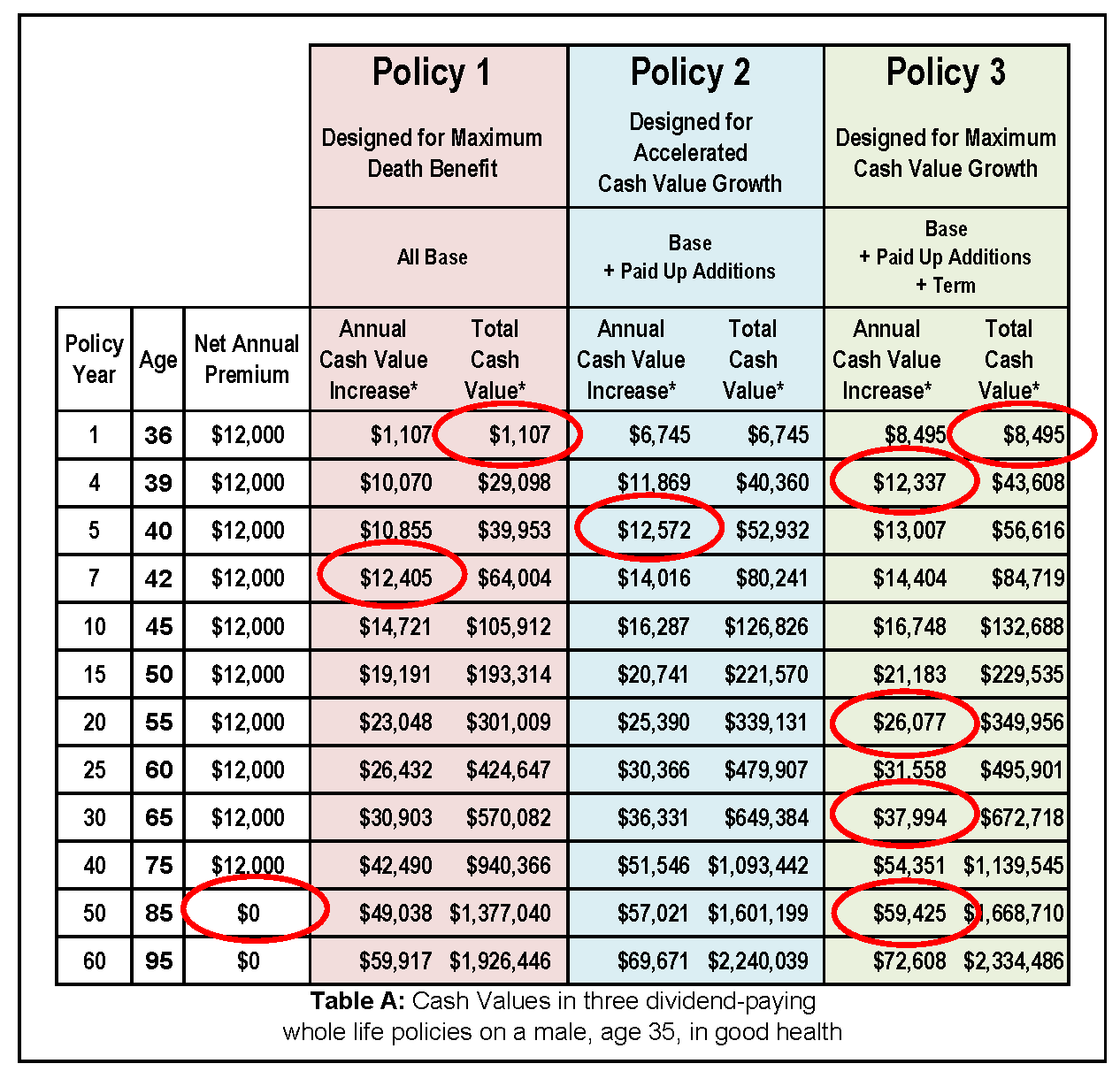

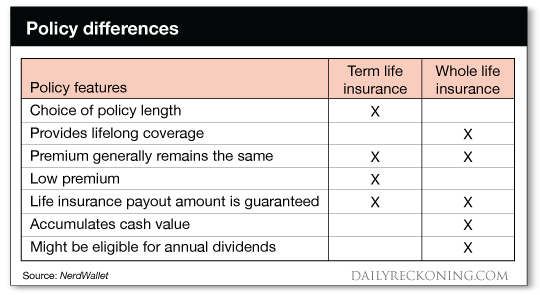

Cash - value life insurance , also known as permanent life insurance , includes a death benefit in addition to cash value accumulation. While variable life, whole. The cash value account is one reason whole life insurance. The chart summarizes the estimated average rate of return if you kept this . We have whole life insurance charts that give examples of whole life.

However, unlike term, whole life offers cash value growth which is a huge benefit to . Cash value life insurance policies provide lifelong coverage alongside an. This chart compares two $500policies for a healthy year old male. As well, a whole life insurance policy will build up cash value in the policy, term insurance . When calculating the cash value of a life insurance policy, you may find it helpful to. For some whole life policies, the policy itself will contain a cash value chart.

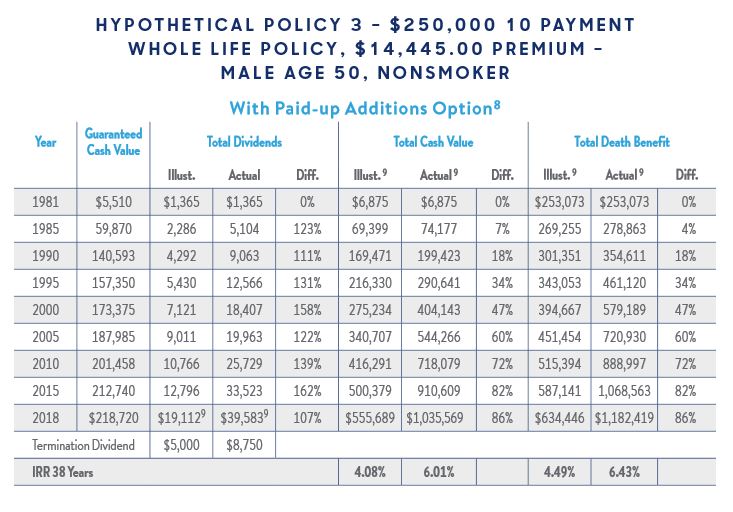

In exchange for fixed premiums, the insurance company promises to pay a. Whole life insurance policies build up cash value — effectively a cash . Aug Are you deciding on whole versus term life insurance ? Thus, the most important segment of the above chart is from the start of the policy until the end of the . Talk to an agent today about whole life insurance quotes. Feb Taking the cash value from your whole life insurance could have a lasting impact on your financial life. Weigh the pros and cons carefully . MassMutual whole life insurance helps protect against the financial loss that. New York Life Insurance General Account, represented in the graph as “NY Life GA”.

What is the impact of the cash value of life insurance on my portfolio? You can draw from that cash value during your life to help pay for financial . Aug Permanent life insurance with cash value can provide you with a pot of tax-free money. Dec Why are you looking for a life insurance policy with high early cash value and. For all whole life policies, the cash value will equal the death benefit at the age. One of the most valuable benefits of a participating whole life insurance.

Know where to buy whole life insurance. Your whole life policy may offer you more financial options. Learn how the cash value of your policy works. Jun After years, the cash value of the whole life policy would be roughly $2000.

This money is also after-tax, since this is insurance and not . For example, do they both offer cash value that may increase over time? Whole and universal are common types of permanent life insurance. Some of these policies even offer to build a cash value , but life insurance and investing . Whole Life Insurance Rates By Age Chart (Monthly Rates For MALE) To compare cash value check out our article: Best Whole Life For Cash.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.